Finance plays an essential role in business and the economy. It is what allows the growth and maintenance of business activities, allowing both individual, corporate, and governmental capitals to flourish. Direct finance refers to financing acquired directly from the lenders. In contrast, indirect finance implies acquiring money indirectly from lenders with intermediaries between both parties, such as banks and other financial institutions.

Indirect finance is very important to understand since it leads the money market, thus indirectly enabling businesses and individuals to raise funds without going through investors. This article will discuss the concept of indirect finance, its advantages, and how it operates within the financial environment.

What is Indirect Finance?

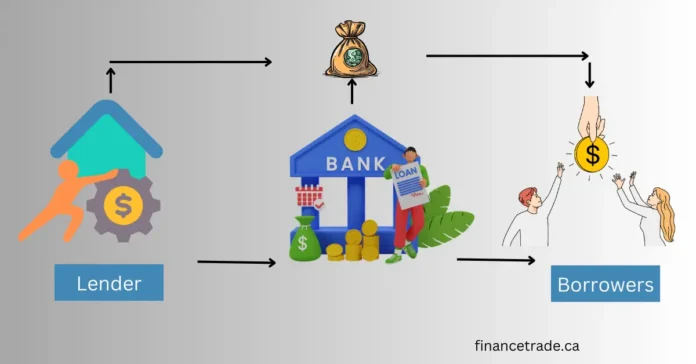

Indirect finance means that the saver’s money reaches the borrower’s hands through a middleman; this can be a bank, credit union, or any other financial institution. Businesses and people do not directly borrow from the investors but take the help of these institutions for funds.

Working in Indirect Finance

- Money is deposited with a bank or financial institution.

- The institution gathers all such deposited money and extends loans to borrowers.

- Borrowers pay back the loan with interest, which the institution earns.

- The institution pays interest to depositors for keeping their money in savings accounts.

Examples of Indirect Finance

- A firm borrowing from a bank

- Homebuyers obtaining a mortgage from a bank

- Students getting an education loan from financial intermediaries

- Indirect finance is the bedrock of modern economies, ensuring an ongoing flow of funds whilst managing risk levels effectively.

How Indirect Finance Works

Indirect finance relies on the role of financial intermediaries, which serve to interface those who have excess funds (savers) and those needing funds (borrowers). Major Indirect Finance Financial Intermediaries:

- Banks-Advances, mortgages, and credit

- Credit Unions-Consumer and commercial finance

- Insurance Companies-Manage risk through investments in the financial markets

- Mutual Funds-Pooling funds from investors to invest them in a wide variety of securities

The flow is designed in such a manner that the flow of funds takes place efficiently and at competitive rates, and at the same time, financial risks are reduced.

Indirect Finance vs. Direct Finance

While indirect finance relies on intermediaries, direct finance occurs when borrowers obtain funds directly from investors through instruments like stocks and bonds.

| Feature | Indirect Finance | Direct Finance |

| Intermediary | Required (banks, institutions) | Not required |

| Risk | Shared with financial institution | Borne by borrower and investor |

| Accessibility | is easier for businesses and individuals | Requires direct investor engagement |

| Costs | Higher due to intermediary fees | Lower as no middleman is involved |

Indirect finance is often preferred for its ease of access and risk management, while direct finance is favored by large corporations seeking funding without institutional intervention.

When to Use Direct Finance?

- Companies having higher credit rating

- Companies avoiding fees from the banks

- Risk surfer investors

When to Use Indirect Finance?

- Small businesses and individuals requiring easy availability of credit

- Borrowers prefer financial institutions to assume risk.

- Those who cannot attract direct investment

These two financing modes also have a role in financial markets, and the choice depends on factors such as risk tolerance, cost, and accessibility.

Types of Indirect Costs

Indirect costs are expenses that are not directly related to a particular product or service but are required for business operations. These costs are categorized into:

Fixed Indirect Costs:

- Rent

- Administrative staff salaries

- Insurance premiums

Variable Indirect Costs:

- Utility bills

- Office Supplies

- Equipment maintenance

- These costs must be managed carefully to ensure profitability and efficiency.

Direct vs. Indirect Loans

A direct loan is borrowed directly from a lender, for example, a government or bank. The indirect loan, on the other hand, is issued through an intermediary financial institution.

- Interest Rate: Direct loans are usually interest-free.

- Process of Approval: Indirect loans are easier to obtain but tend to have harsher terms

- Repayment: Direct loans will usually have relatively flexible repayment dates.

Choosing the right loan depends on the borrower’s financial situation and needs.

Research Indirect Cost Funding Distributions

Indirect cost funding is allocated on several factors, which include project size, operational requirements, and governmental regulations. Many institutions usually fund administrative and support costs from indirect cost funds.

- Determinants of Indirect Cost Allocation

- Government policies

- Business revenue models

- Market conditions

Knowing the distribution will enable an organization to be able to manage costs well.

How Indirect Costs Apear on an Income Statement

Indirect costs are reported on financial statements through various categories, depending on what they are. Unlike direct costs, which are directly associated with production or service delivery, indirect costs are categorized as overhead expenses.

Common Indirect Costs in an Income Statement

Administrative Expenses: Office salaries, legal fees, and consulting fees.

Operating Expenses: Rent, utilities, insurance, and depreciation.

Marketing and Distribution Costs: Advertisements, promotional activities, and transportation costs.

How They Are Accounted For

Indirect costs are reported as part of general and administrative expenses in the income statement. Indirect costs are assigned to departments using either a usage or cost driver. Accurate assignment will allow a company to correctly report profits and losses so that a company can properly control its costs. Indirect costs can greatly affect the profitability of a business. It is essential to monitor indirect costs and allocate them accurately.

Identification of Units for Allocation

Allocating indirect costs requires the identification of measurable units that best represent how expenses are being distributed. Common Allocation Units:

- Labor Hours: Used in service-based industries where the amount of time consumed by employees affects costs.

- Machine Hours: Commonly used in the manufacturing industry where usage of equipment determines expense allocation.

- Square Footage: Used to allocate rent and utility expenses in shared office buildings.

- Revenue Percentage: Applied in firms where indirect costs are shared over many products or services.

Why Proper Allocation Matters

- Avoids overstatement of the financial performance.

- Supports informed price and budgeting.

- Also ensures tax and account-keeping consistency.

The right units for allocation help ensure that indirect costs are properly and correctly distributed by businesses, which in turn improves financial transparency.

Advantages of Indirect Finance

Indirect finance majorly supports the development of the economy through structured and accessible funding options. Key Benefits include:

- Easy Access to Funds – no need for borrowers to find direct investor connections.

- Risk Management – The financial institution absorbs the risk of lending, safeguarding the risk of individual investors.

- Professional Loan Management – Banks and credit unions undertake loan structuring, making it easier for the business to concentrate on growth.

- Economic Growth – Indirect finance facilitates smooth capital flows across industries and enhances economic development.

- Diversification – Depositors enjoy diversified investment opportunities through financial intermediaries.

By using indirect finance, businesses and individuals can raise the funds they require while enjoying structured financial management.

Disadvantages of Indirect Finance

Despite its advantages, indirect finance has some drawbacks that borrowers should consider.

Potential Downsides

❌ Higher Interest Rates – Intermediaries charge additional fees, making loans more expensive.

❌ Dependency on Financial Institutions – Borrowers rely on banks and lenders for fund approvals and terms.

❌ Strict Loan Conditions – Financial institutions may impose stringent eligibility criteria.

❌ Limited Control Over Investments – Savers and investors have less say in where their money is allocated.

❌ Potential Delays in Fund Disbursement – Processing times for indirect loans can be longer than direct finance options.

Understanding these challenges can help businesses and individuals decide whether indirect finance aligns with their needs.

Indirect Finance in Practical Applications

The areas of industries through which indirect finance is observed with the transactions making growth a possible reality are enumerated below:

Small Business Loaning: Direct investor funding of entrepreneurship is circumvented by providing direct loans by a bank to accumulate funds collected by depositors from them.

Lending against mortgaged residential property: The mortgagor gets finances, and banks accumulate funds collected by depositors from them.

Buying a vehicle: Financing obtained either from independent credit institutions or via third-party banks.

Government-Backed Loans: The SBA (Small Business Administration) enables indirect financing for startups.

Mutual Funds and Pension Funds: Investors pool money, which financial institutions manage and disburse.

These are just a few examples of how indirect finance plays a critical role in capital availability to the individual and the business.

The Future of Indirect Finance

The financial sector is changing, and indirect finance is changing with the new trends and technologies.

Future Trends of Indirect Finance

FinTech Innovations: Digital loan platforms and credit scoring through Artificial Intelligence are altering the traditional models of banking.

Decentralized Finance, or DeFi: Blockchain lending and borrowing networks are emerging to challenge the system.

Green Finance and Sustainable Investments: All financial institutions emphasize green financing as well as social responsibility investments.

Regulatory Improvements: National governments are rewriting financial regulations that are more open and efficient.

It also includes increased competition from alternative lenders and peer-to-peer (P2P) platforms. Due to the ongoing innovation and growth of indirect finance, it will remain available to individuals in more accessible and efficient forms.

Conclusion

Indirect finance is one of the foundations of modern financial systems. Indirect finance can help people and organizations obtain funds from intermediaries like banks, credit unions, and other financial institutions. It has structured lending, effective risk management, and even opportunities for economic growth. This comes with higher costs and dependence on financial institutions. Being aware of the distinction between indirect and direct finance makes businesses and individuals make appropriate financial decisions.

Indirect finance will evolve to embrace the shift by the financial industry to embrace digital transformation in a way that ensures capital stays accessible and effectively allocated across economies.

FAQs

Indirect finance enables individuals and firms to obtain capital through intermediaries, providing a structured, efficient borrowing process.

This provides small business firms with an opportunity to acquire loans without requiring direct investor involvement, thus providing them with more accessible funds to expand and conduct their operations.

Banks, insurance companies, and mutual funds form the intermediaries whereby financial transactions are undertaken between savers to borrowers.

Indirect costs include administrative expenses, rent, and others. These will reduce the company’s net income if not controlled.

It depends on the borrowing needs. Indirect finance is more accessible and less risky. The higher costs and lesser investment control are afforded by direct finance.